Introduction

In the aftermath of Tesla’s Q4 earnings report, the electric car giant faced a significant hit as its stock dropped nearly 8%. This article delves into the details of the earnings miss, the downbeat production outlook, and the noteworthy announcement by CEO Elon Musk regarding the company’s next-generation vehicle.

Tesla’s Stock Drop: Q4 Earnings Report Details

Tesla reported top-line revenue of $25.17 billion, slightly below the estimated $25.87 billion. Profitability metrics, including adjusted EPS and net income, also fell short of expectations. The earnings report reflected a 3% increase in revenue from the previous year.

Full-Year Production Outlook

In a surprising move, Tesla cautioned that its full-year vehicle volume growth rate might be notably lower than the growth rate achieved in 2023. This announcement, linked to the launch of the next-generation vehicle at Gigafactory Texas, disappointed investors and fell short of Street estimates for 2024.

Next-Gen Vehicle Announcement

Despite the gloomy production outlook, Elon Musk brought a ray of optimism by confirming the arrival of Tesla’s next-generation vehicle in the second half of 2025. Musk emphasized the revolutionary manufacturing system that this vehicle would bring to the market.

Market Reaction

The immediate aftermath of Tesla’s earnings report was a nearly 8% drop in its stock during premarket trading. Several factors, including the earnings miss and the downbeat production outlook, contributed to this negative market response.

Factors Influencing Profitability

Tesla’s drop in profitability can be traced back to downward pressure on margins since the company initiated cost-cutting efforts in late 2022. The Q4 gross margin of 17.6% fell below the estimated 18.1%, reflecting a significant decline from the previous year.

Jim Harbaugh’s NFL Comeback: From Wolverines Glory to Chargers’ Charge

Why Maine Dismiss Trump’s Appeal on Ballot Decision

Recent Headlines and Challenges

Headlines involving Hertz shedding thousands of EVs, Tesla reducing prices in China, a production halt in Berlin, and Elon Musk’s stock-related demands have added to the challenges faced by Tesla, impacting its profitability and market perception.

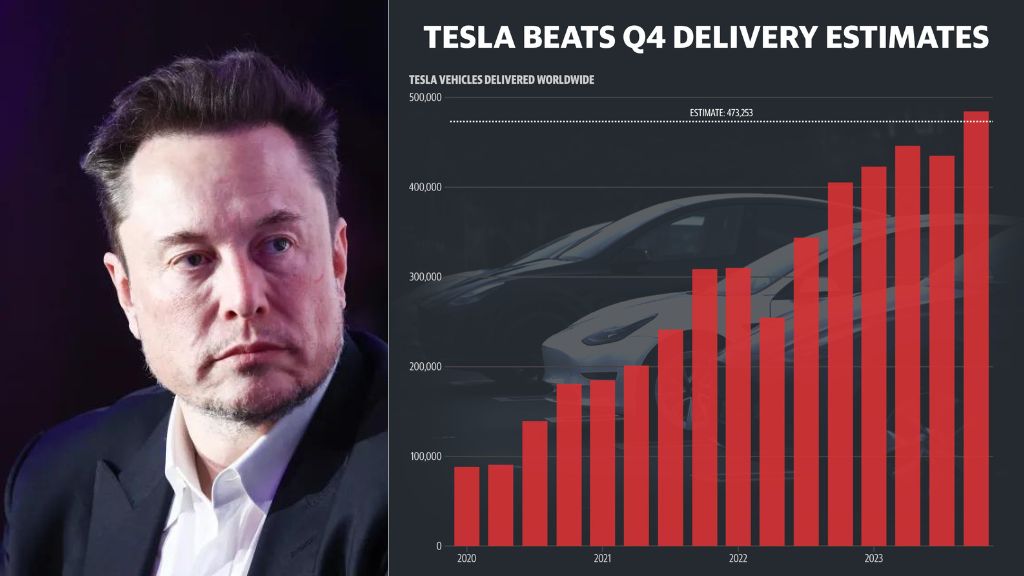

Q4 Delivery and Production Highlights

Despite the challenges, Tesla reported a record-breaking 484,507 deliveries in Q4, surpassing Street estimates. The year-over-year growth in deliveries and production showcased the company’s resilience, with 38% and 35% increases, respectively.

Cybertruck Updates

The Q4 delivery update demanded specific details on Cybertruck deliveries, but Musk’s commentary stressed the immense demand for the Cybertruck. The product ramp, still, is anticipated to take longer compared to other models.

Musk’s enterprises on Control

Elon Musk addressed enterprises about his control over Tesla, expressing worries that his current shareholding might affect in him having” so little influence” in the future. He cited implicit hindrance from major shareholder premonitory enterprises as a cause for concern.

Conclusion

In conclusion, Tesla’s Q4 earnings report had a profound impact on its stock value, revealing challenges in profitability and product growth. Despite lapses, Elon Musk’s advertisement of a coming- generation vehicle brings stopgap for the future, pressing Tesla’s commitment to invention.